Are Millennials Making Prepaid Cards the “Must Have” Payment Product?

One of the most persistent topics when it comes to financial services and Millennials is that they don’t like credit cards. The most recent numbers are telling:

- 63% don’t have a single credit card, according to a Bankrate survey.

- 36% have never had a credit card, based on research from CreditCards.com.

For Millennials, the prepaid card seems to be the product of choice. A recent study by TD Bank found that 33% of Millennials currently use or have a reloadable prepaid card. As recently as a couple years ago, conventional wisdom was that prepaid cards were best for very specific segments like teenagers, older adults or the underbanked. But it appears that Millennials are once again disrupting the landscape and bucking that conventional thinking.

But why is it that are prepaid cards seem to be gaining popularity while credit cards are fading? Three thoughts come to mind:

- It’s a cashless world – Millennials grew up in an age of plastic when credit and debit cards were taking over cash and checks as the leading ways to pay, so it’s natural that they would seek a card payment tool.

- Staying in control – And yet, credit cards lack the spending controls of prepaid cards. With prepaid you can’t overspend and get into debt because you can’t spend what you don’t have.

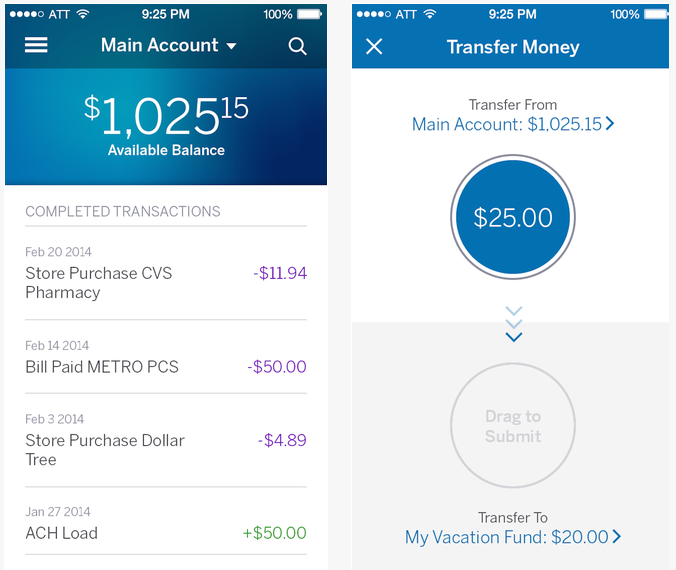

- Mobile integration – Millennials live on their phones, and the leading prepaid card issuers also offer mobile apps giving cardholders ability to make transfers, check balances and track spending in real time.

Focusing on prepaid over credit to target Millennials may require some financial institutions to rethink their product and marketing approach. Here are a few suggestions that we have to help:

Think product “integration” over product “migration”

Moving Millennials from prepaid to credit is a key goal for FIs. But expecting Millennials to wake up one day and suddenly switch from prepaid to credit seems unrealistic. We’ve talked about product migration in the past, but maybe it’s time to start thinking about integration. FIs can look to pair products together so that prepaid becomes part of an overall offering alongside checking and credit. The advantage is that banks have more to offer than non-bank prepaid issuers, and Millennial customers might begin to slowly migrate from prepaid to other payment options. For example, BB&T offers the MoneyAccount Visa Prepaid card that’s positioned as a companion to a checking account, not a standalone product.

Enhance the value proposition

Prepaid cards are fairly transactional, and most lack the strong value propositions that are seen in credit cards. But if issuers think of them as utilitarian, they are missing an opportunity. Of course the uses for the cards beyond POS payments (like bill pay or getting cash) are obvious things to call out. But some cards go further, adding to the value proposition of the card.

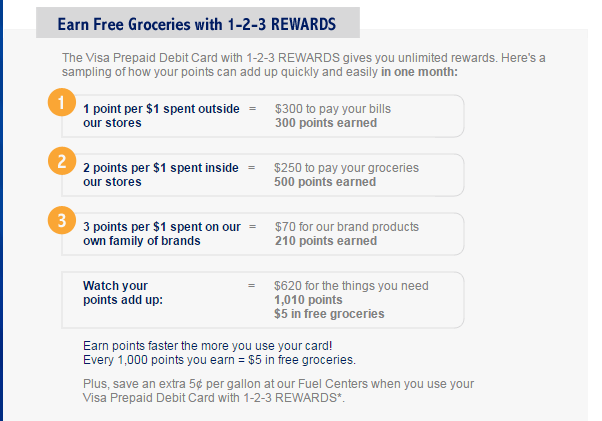

A fairly “low lift” example is the Visa Buxx card which allows teens to personalize their look with over 100 pre-set card designs to choose from and the option to upload a photo of their own. But the Kroger co-brand prepaid card goes so far as to add rewards to the product offering. These value proposition additions help set these two cards apart from competitors and give Millennials reasons to remain loyal.

Offer a robust mobile app

The always on-the-go Millennial generation is mobile first, so a successful prepaid product needs to have a strong mobile app. Many issuers offer apps, but it’s essential to remember that this is a very mobile savvy audience. Robust features and benefits are key, but so is a good user interface.

After a quick look at a few of the apps out there, the American Express Serve card app caught my eye. The look of the app is very clean, and it has a very long list of features making it more of an overall money management tool than a simple way to move or deposit funds.

The new data on prepaid card use by Millennials is telling. It seems that this all important segment may end up holding on to these “starter” products longer than issuers would like. And with fierce competition to reach Millennials with relevant financial products, issuers are surely going to jump on the prepaid bandwagon and either add products or up their current offerings. So it’s essential that you have a solid product offering and a prepaid card that will attract Millennials, along with clear ways to promote those cards and begin to build long term loyalty.