9 Content Marketing Trends of Note for Financial Services

As you know, we’re big advocates for content marketing in financial services – as long as it’s part of a goal-oriented, business-driven strategy. And while it’s always important to monitor and adjust campaigns and strategies as they go along, it’s also vital to step back from time to time and check in with the big picture: Are you utilizing best practices?

To facilitate those discussions among your marketing teams, we’ve put together some highlights from the trends and predictions pieces that are often discussed this time of year, while relating them, specifically, to financial services:

1.

“Though many still treat content marketing as an experimental trend, brands are quickly learning that there’s a science to creating content – and spending their sacred budget” (SOURCE: Contently’s “State of Marketing Heading into 2015” report).

Once financial institutions (FIs) jumped – or maybe tiptoed – into social media and content marketing, they experimented like everyone else to see what worked and what didn’t work. For example, several FIs – like Chase, U.S. Bank and PNC – are streamlining some of their Facebook pages by merging different profiles into one when it makes sense.

Changes like these are related both to the data/anecdotal evidence gathered in prior experimental phases and to the advancement of targeting options by the social platforms. The result is more science behind content creation: since social media is no longer “free” and organic reach no longer guaranteed (see “How Facebook Zero Will Impact Financial Services Marketing”), financial brands are learning the most effective ways to invest in content.

2.

“We will see content as an experience. What we’re looking to do is create a great experience across all content touch points” (SOURCE: Melissa Breker in “17 Marketing Influencer Predictions for 2015”).

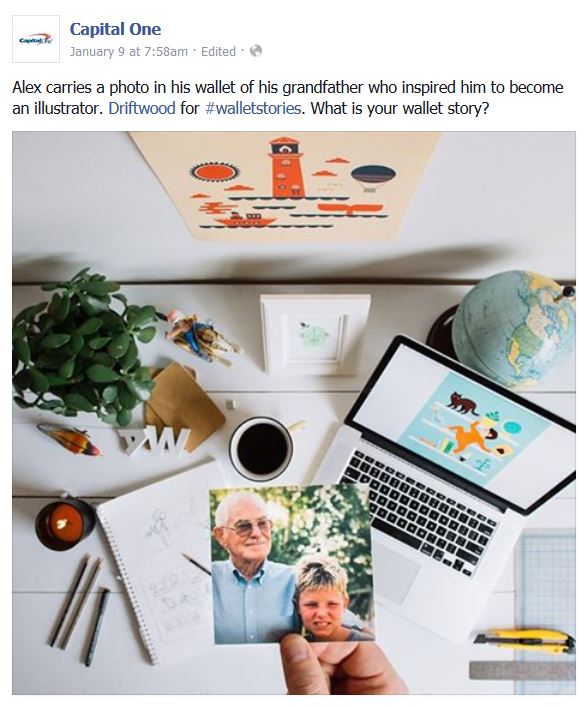

It’s no longer enough for marketing to define consumer perception of financial brands: marketing has to create an experience of the brand. Wells Fargo did this with its pop-up stores during the Apple Pay launch. And more recently, Capital One began creating experience-based content utilizing its longstanding tagline, “What’s in your wallet?” In addition to the launch of Capital One Wallet (a mobile banking app that works with Apple Pay), the brand is using its social channels to tell consumers’ #walletstories. The stories bring the Capital One tagline to life since what’s in consumers’ wallets prove to be items related to significant life experiences (careers, romance, family, adventures, etc.).

Note the use of influencers in these, such as Zach Driftwood and Paul Octavious, both photographers/creators with large followings on social media. Most importantly, note the tone – “@zachdriftwood for #walletstories” – the content is positioned as though the influencer is reporting on an experience or event.

3.

“It’s a necessity to take advantage of “content in your pocket,” that is, content that goes everywhere the user goes” (SOURCE: Steve Farnsworth in “17 Marketing Influencer Predictions for 2015”).

Mobile. Mobile. Mobile. You guessed it: mobile is a big part not only of what’s next, but what’s happening now. And despite the evolution and refinement of mobile banking apps, FIs have a long way to go with mobile content. Take email, for example. Mobile click rates on emails from banks and other financial service providers are roughly 2%, the lowest for any industry. While this is partly due to the industry’s relationship with private personal information (consumers may be disinclined to open account-specific info on their mobile devices), FIs will need to learn to produce content that is valuable to consumers on the go and compatible with their digital-content consumption habits.

4.

“The value of co-creating content with the very audience you want to do business with is very powerful” (SOURCE: Lee Odden in CMI’s “60 Content Marketing Predictions for 2015”).

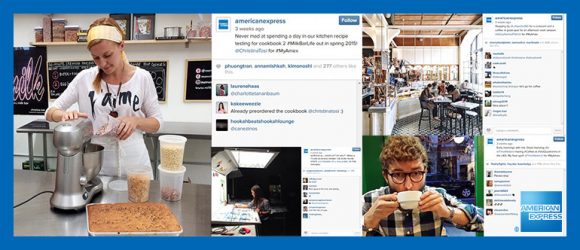

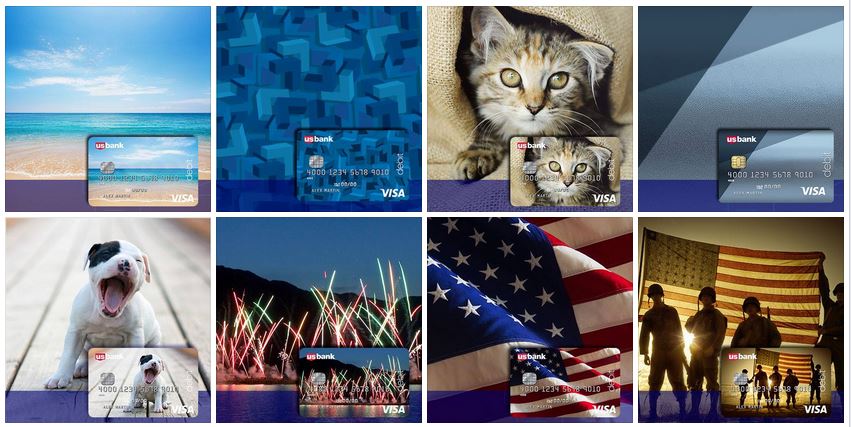

Odden calls this “participation marketing,” and there are already some great examples of it in financial services. For example, Amex has allowed customers to take over its Instragram account, and when making changes to its card designs (including offering “designer options”), U.S. Bank consulted fans for ideas, as in this “choose your favorite” photo album on the brand’s Facebook page:

In financial services, as in other industries, we believe “participation marketing” will evolve from takeovers and crowdsourcing into ideas for campaigns with even more meaningful engagement.

5.

“Distribution gets proper attention, and competition for [consumer] attention means brands will need to invest more in creating content that people genuinely love” (SOURCE: Contently’s “State of Content Marketing 2014” report).

Content marketing isn’t just about content creation: brands cannot overlook content distribution. And while “content in your pocket” (#3) and “hyper-relevance” (#5) are related to content distribution, they aren’t the only avenues. In fact, getting people to share content with their own networks is one of the most powerful ways to get lots and lots of eyes on branded content. Even though few pieces of content truly “go viral,” those that are shared most broadly have one thing in common: people love them. Remember TD Bank’s #TDThanksYou extravaganza? Without exciting, emotional, humorous, insightful or helpful content, it’s going to be hard for a brand to get attention.

6.

“People will realize that being the same as everybody else will not get you ahead in the industry” (SOURCE: Charlotte Bennett-Smith in CMI’s “60 Content Marketing Predictions for 2015”).

If you don’t differentiate your brand and your products you’re in trouble. And in a heavily regulated industry like financial services, that can be challenging. In order for content to stand out, it needs to be part of a strategy that advances those products, services and brand qualities that make you unique. Take a look at Simple’s brand promise, which is based on the customer experience, for example. And consider Capital One 360’s recent efforts, including branded cafes and a social promotion to create its very own words for “financial feelings.”

7.

“Social media and mobile marketing are critical enablers of products and services” (SOURCE: “Key Take-aways from SalesForce’s 2015 State of Marketing Report”).

To see how this is playing out in financial services, you don’t need to look any further than the way FIs promoted their participation with Apple Pay. Whether they were a launch partner, like JPMorgan Chase, or came on board thereafter, FIs continue to use social content to promote Apple Pay.

Social media marketing has been – and will continue to be – utilized to advance other products, services and offers, as well, just as with #incredouble, Citi’s social promotion for its Double Cash Card.

8.

“Millennials expect you to understand their needs, preferences and passions: you’ll need to bring your A-game” (SOURCE: “Millennials are not impressed with your content marketing”).

We’ve written a lot about how FIs can market to Millennials, including how to be relevant to this important segment. Put into play, an FI bringing its A-game to Millennial marketing might look a bit like Discover’s #discoverjoy promotion, in which the brand gifted – via simple surprise and delight – $5 Starbucks gift cards to its customers. But since Millennials are acting as disruptors to the industry, their actual needs are much deeper than that: both products – and the content that supports them – must be designed specifically for them. In addition, promotional content must be delivered in a way that says, “We get you” (see, for example, some success Amex has had with music and gaming).

9.

“One critical trend among consumers – particularly at the affluent end – is the waning desire to invest time and energy in actively researching information” (SOURCE: Upward Home’s “2015 Checklist for High-End Home Brands”).

Although we found this one in an interesting place, Upward Home, it has clear relevance to FS. Upward Home quotes Micah Solomon in a Forbes article on 2015 trends, “Customers now expect personalized, aggregated information – instantly,” and we agree this expectation is particularly true with affluent consumers. If an FI does not serve up what affluents need when and how they need it – and in a way that’s an expression of their lifestyle – the FI risks losing customers to a competitor with more accessible, relevant content.