Gas Pump Confessional: Smartphone Payments that Bypass Interchange

It’s late, about 1 a.m. A snowy forecast has me running out after a long day to fill up the truck and snow blower gas cans with fuel at my local Cumberland Farms convenience store. Getting from “E” to “F” at four bucks per gallon is a $154.00 endeavor. The first flakes begin to fall. Tomorrow morning I will wake to 8” of snow on the ground.

It’s late, about 1 a.m. A snowy forecast has me running out after a long day to fill up the truck and snow blower gas cans with fuel at my local Cumberland Farms convenience store. Getting from “E” to “F” at four bucks per gallon is a $154.00 endeavor. The first flakes begin to fall. Tomorrow morning I will wake to 8” of snow on the ground.

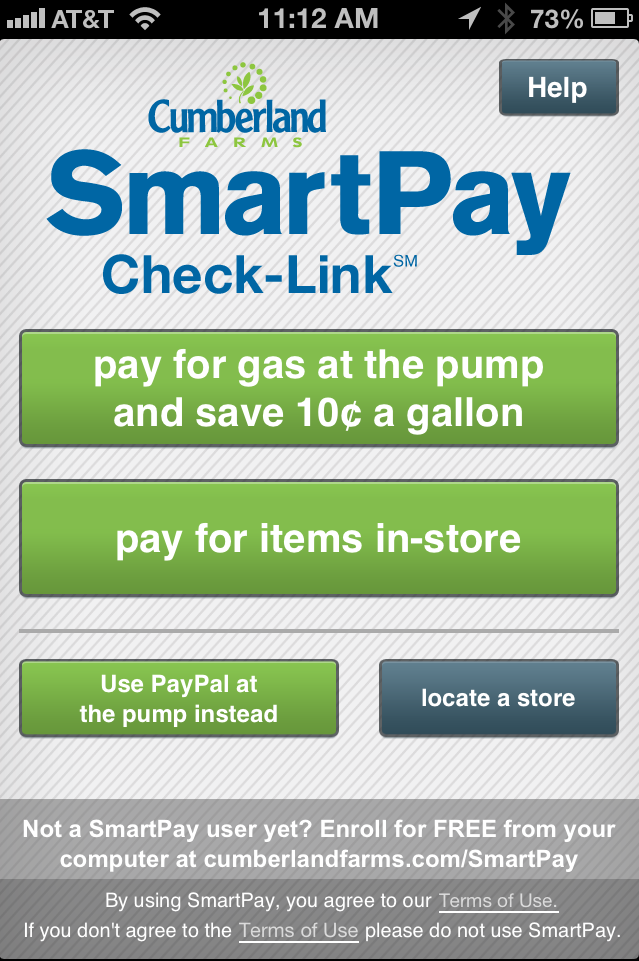

While I am filling the tank, I notice a take-one fixture attached to the pump promoting “Cumberland Farms SmartPay Check-LinkSM.” I pick up the brochure.

What it is

SmartPay is a merchant-branded ACH decoupled, private-label, direct-debit product. To the consumer, SmartPay is a mobile-enabled smartphone app that incentivizes purchases at Cumberland Farms and makes transactions easier. For the merchant, it’s an electronic funds transfer platform which clears payment at a cost far less than what’s available from traditional interchange schedules.

The hook

The idea of making retail purchases via a smartphone holds little appeal to me; it will take more than convenience to motivate me. The heavily touted incentive here is the opportunity to “Save 10¢ on Every Gallon, Every Day.” Gas is something I buy a couple of times a week. A quick mental calculation has me potentially saving $3.85 on my fill-up. That is slightly better than what my credit card is offering in terms of cash-back rewards – and it’s an instant discount, not points added to a total that I always forget to redeem.

Using SmartPay

My first experience with the SmartPay app was over a week after that snowstorm, and I have to say it’s pretty slick. Open the app, and you’re ready to go. Press the “pay for gas at the pump and save 10¢ a gallon” button in the app, and it prompts you for your email address (which it, at your option, can remember) and the PIN code you designated during online set-up. Enter the Cumberland Farms Store number from the tag prominently displayed on the pump, and a map pops up with the address of the store and an integrated GPS dot to show you that you’re at the right place. Once you enter the pump number, the pump turns on… and the price per gallon drops 10¢.

I felt like I was suddenly a treasured customer – or a guy who just stole something. I pump my gas, no longer feeling like a thief as my purchase vacuums $64.00 out of my checking account… albeit saving me $1.70.

I felt like I was suddenly a treasured customer – or a guy who just stole something. I pump my gas, no longer feeling like a thief as my purchase vacuums $64.00 out of my checking account… albeit saving me $1.70.

As I drive off my iPhone beeps. It’s a very comprehensive confirmation email summarizing my “Recent SmartPay Purchase.” (The website has a nice interface that historically tracks purchases, as well.)

Behind the SmartPay product

The National Payment Card Association (NPCA) administers the product. NPCA serves as both the issuer and processor, via a license from Pulse Network (Discover).

The product offers merchants low, fixed-cost transactions (fees are 15¢ per transaction regardless of total, offers next-business day settlement and a transaction guarantee with no chargebacks) and provides consumer data to the merchant that can tie to a new or existing customer loyalty program. The information collected and provided to merchants includes the consumer’s name, email address, phone number, shopping frequency and total spend.

NPCA touts its program as a turnkey solution that includes everything from the consumer online enrollment engine, card management systems, authorization decision-making, a call center and regulatory compliance.

What to watch

- Retailers: Installing the app was simple: I scanned a QR code. But setting up the “backend relationship” between the app and my checking account was time consuming and tedious. I bought gas twice while I was waiting to get through that process, which included logging into the SmartPay website, providing personal and account data and confirming the test deposit/withdrawal. Although there’s no good way right now to streamline establishment of the initial financial relationship, retailers must recognize that until they develop a streamlined solution, they’re going to lose potential participants whenever they require a heavy lift. The reward has to be worth the effort.

- Financial institutions: Cumberland Farms isn’t the only merchant with a customer loyalty program that bypasses interchange fees associated with credit cards. The NPCA offers the same or similarly private-label branded smartphone and accompanying “swipe and pay” private-label debit card programs to over two dozen merchants. I would expect this list to grow… and I would expect credit card issuers to figure out a way they can reclaim some of this territory.